Introduction

With each passing day, more and more people are moving to e-banking to ease their lives and make hassle-free transactions. Banking is now shifting from the traditional method of how we manage our finances, giving us the power to bank on the go. The global banking platform market is worth USD 7.75 billion in 2024, and it’s expected to grow at a compound annual growth rate (CAGR) of 10.70% to reach USD 17.50 billion by 2030.

Many users now choose to get their work done using the mobile app service rather than going to the bank and waiting in queues. But what exactly are the necessary steps to consider and features to include for developing a banking app that stands out? Let’s find out.

Looking to develop a mobile app?

Steps For a Successful Mobile Banking App

Market Research and Idea Validation

The first step is always the research, regardless of the task, and app development is no exception. Before jumping straight to the development process, you must analyze everything from a business point of view. Start by researching competitor apps and identifying gaps that need to be filled to grab the opportunities in the market. Define your target audience and work to justify the value of your app to customers; use techniques such as surveys and user personas to gather data on what your customers actually desire.

The fintech apps hold sensitive information of the users; therefore, you need to check on compliance with banking regulations and data protection laws to make sure your app will meet the necessary legal requirements.

Features Specifications & Prototype

Once your idea is validated, start working on making an MVP of your app, this helps in collecting user feedback and identifying any gaps in the early stages without investing too much time and money. It is good to test your idea before launching the app on a full scale.

From basic to advanced, mark the priority of all the features and determine their sequence of implementation. Defining the features early helps shape the entire project.

Design and Development

After the completion of your MVP, you start working on the design and development of the app. The designing phase consists of creating an intuitive and user-friendly interface (UI) with a strong focus on user experience (UX). Your site should be simple and quick to use, so people can have a positive experience while using the app. Here you create wireframes, and prototypes, and continually work to refine the layout, navigation, and information flow of the app. Make sure that the main screen has quick access to the most commonly used features.

As soon as your design is finalized, the developers start to build your banking application as per the design and approved requirements. Choosing the right technology is crucial at this stage for developing a successful app.

A few modern tech stack suggestions for a banking app are listed below:

- Backend Development: Node.js, Nest JS, Express JS

- Frontend Development: React Native

- Database: Mysql, Postgres, Mongo Db, DynamoDB, Firebase

- Security Tools: SSL, Multi-factor Authentication (MFA), and End-to-End Encryption (E2EE)

Testing & Quality Assurance

You should conduct continuous testing throughout the development process to spot and fix bugs early, which contributes to saving time and resources later on. Make sure every line of your code is tested and works as intended. Thoroughly go through the functionality, performance, and security of the app; your goal here is to spot bugs before your users do and provide them with a smooth experience.

Some common tests are:

- Functionality Testing

- Performance Testing

- Security Testing

- Usability Testing

Launch the App

When you are ready to launch your product, the most important step is to market your app and inform as many people as possible. For this, you can hire a marketing agency to promote your app or run a social media campaign. This will create a buzz and attract many users. Other than that, plan a phased launch strategy starting with a small group of users to gather initial feedback and resolve any emerging issues before a full-scale release.

Maintenance and Updates

The job isn’t completed by just launching the app. Banking applications need constant maintenance to resolve any bugs or issues promptly, this helps in keeping the users satisfied. Regular updates are also necessary to add new features and keep the app compatible with the latest operating systems. Consider setting up a feedback loop so that users can easily report problems and suggest improvements.

Must-Have Features of a Banking App

Bank Account Details

Your users should be able to access all of their account information easily from the home screen. This includes letting them check their current balance and hiding it for privacy. The user should also be able to view their recent transaction as well as detailed account statements.

Make this section easy to navigate with a simple layout and readable fonts. A user-friendly bank account details section helps users feel in control of their money, reducing the need for customer support.

Fund Transfer

Another basic and must-have feature for a banking application is the fund transfer option. Your user must be able to easily and securely send/receive payments from other accounts within the same bank or interbank transfer. Including the options for sending money overseas with real-time updates on fees and exchange rates is a plus.

Make sure that this whole process is smooth if your app makes it difficult to send money, users are likely to switch to a competitor.

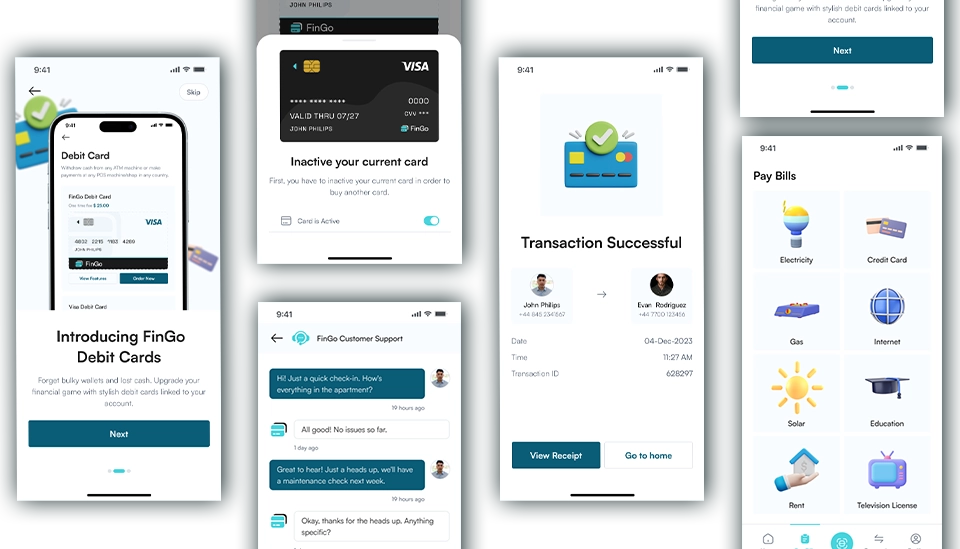

Bill Payment

We all have bills to pay; therefore, simplifying the process will be a great plus for your app. By making bill payments quick, you can position your app as a go-to solution for users’ everyday financial management. Include an option for users to pay utility bills, credit card dues, and other expenses directly through the app. You can also add a feature for bill reminders and the ability to schedule payments for convenience.

Customer Support

Customer assistance is an important component of every application. You must provide your users with a dedicated support portal where they can submit complaints and resolve any difficulties that they may encounter.

Chatbots have made customer assistance easier than ever. You may personalize and automate the bot for prompt response and resolve queries. Other than chatbots, you should provide multiple support options, including call and email support.

Security

For a banking application, security is non-negotiable and cannot be compromised. Your customers trust your app with their most sensitive information. Any security violation can be damaging and cause users to lose trust in your app. Some must-have requirements that need to be considered for your banking apps are as follows:

- Biometric Authentication: Fingerprint or facial recognition provides an extra layer of security with convenience.

- Multi-Factor Authentication: Combining something the user knows (password) with something they have (mobile device) is a must.

- Encryption: All data transmitted between the app and bank servers should be encrypted to prevent unauthorized access.

Account & Card Management

Allow your users the convenience to manage their cards and accounts from the app. Through this, users can stop unauthorised transactions by reporting a lost or stolen card. This increases the security and the app’s credibility. Adding functionalities such as viewing and changing PINs, setting spending limits, and temporary card blocking can be advantageous.

Advanced Features of a Banking App

QR Code Payments

Payments made with QR codes offer a quick and contactless way of managing transactions. Users can scan a QR code for in-store purchases or for peer-to-peer payments. It’s a useful advanced feature that improves the user experience.

Gamification

Gamification is including game-like features in web and mobile apps to engage users. This functionality allows users to earn points for each transaction, which can be redeemed for rewards. Motivating users to use your app more frequently.

Stock Market Analysis

Add tools that let people analyze stock market patterns and make smart investment decisions. Integrating features for real-time market updates and personalized investment recommendations positions your app to become a complete financial management platform.

Zenkoder specializes in banking app development!

Conclusion

With 10+ years of experience in developing mobile and next-gen fintech solutions, Zenkoders is one of the best app development companies in the United States. Our firm provides full services for developing advanced banking applications. The team of our skilled developers uses modern technology to create user-friendly and secure fintech apps.

So, there you have it! Developing a mobile banking app is a complex job that requires careful planning and strategic execution. But by following a structured approach and incorporating the right features, you can develop an app that everyone will love. Try building an app that makes users’ lives easier, and prioritize security so that people can trust you with their money.

FAQs:

What are the essential steps for mobile banking app development?

Mobile banking app development includes planning, UI/UX design, backend integration, compliance, and security implementation. Testing ensures reliability before launch. Agile development allows faster delivery with scalability. Our IT services provide end-to-end solutions, ensuring financial institutions create secure, user-friendly apps that align with customer expectations while meeting global financial compliance and security standards.

What key features should a mobile banking app include?

Core features include secure login, funds transfer, bill payments, transaction history, and notifications. Advanced apps integrate biometric login, AI-powered insights, and fraud detection. We design banking apps with modern technology and compliance in mind, ensuring financial institutions deliver secure, feature-rich, and user-friendly platforms that enhance trust, customer satisfaction, and long-term engagement.

How much does it cost to develop a mobile banking app?

Costs depend on complexity, compliance, and integrations. A basic app ranges between $40,000–$70,000, while advanced enterprise apps with AI, analytics, and fraud detection may exceed $150,000. Our IT services provide flexible pricing tailored to your needs, delivering cost-effective yet secure solutions aligned with financial industry standards and digital transformation goals.

How long does it take to build a mobile banking app?

Timelines vary by project scope. Simple apps may take 14–20 weeks, while advanced apps with AI and compliance testing can take 6–12 months. Using agile methodologies, we deliver MVPs quickly, allowing financial institutions to launch early while scaling features gradually. This ensures faster time-to-market with security, compliance, and scalability built in.

How important is security in mobile banking apps?

Security is the backbone of mobile banking apps. Key measures include two-factor authentication, data encryption, and fraud detection systems. Compliance with PCI DSS and GDPR is critical. Our IT services ensure apps are built with advanced security layers, protecting sensitive financial data while fostering customer trust and ensuring safe, compliant digital transactions.

How do mobile banking apps ensure compliance with regulations?

Compliance ensures banking apps meet strict financial industry laws like PCI DSS and GDPR. Apps must secure data, encrypt transactions, and monitor activity to avoid risks. We specialize in building apps that adhere to global and regional regulations, enabling financial institutions to maintain legal compliance while delivering secure, reliable digital banking experiences.

Why partner with Zenkoders for banking app development?

Banking app development requires deep expertise in security, compliance, and scalability. Partnering with Zenkoders ensures faster delivery, cost control, and long-term support. We provide full-cycle solutions from planning and development to compliance checks and maintenance, helping financial institutions launch secure, competitive, and future-ready apps that meet customer demands effectively.